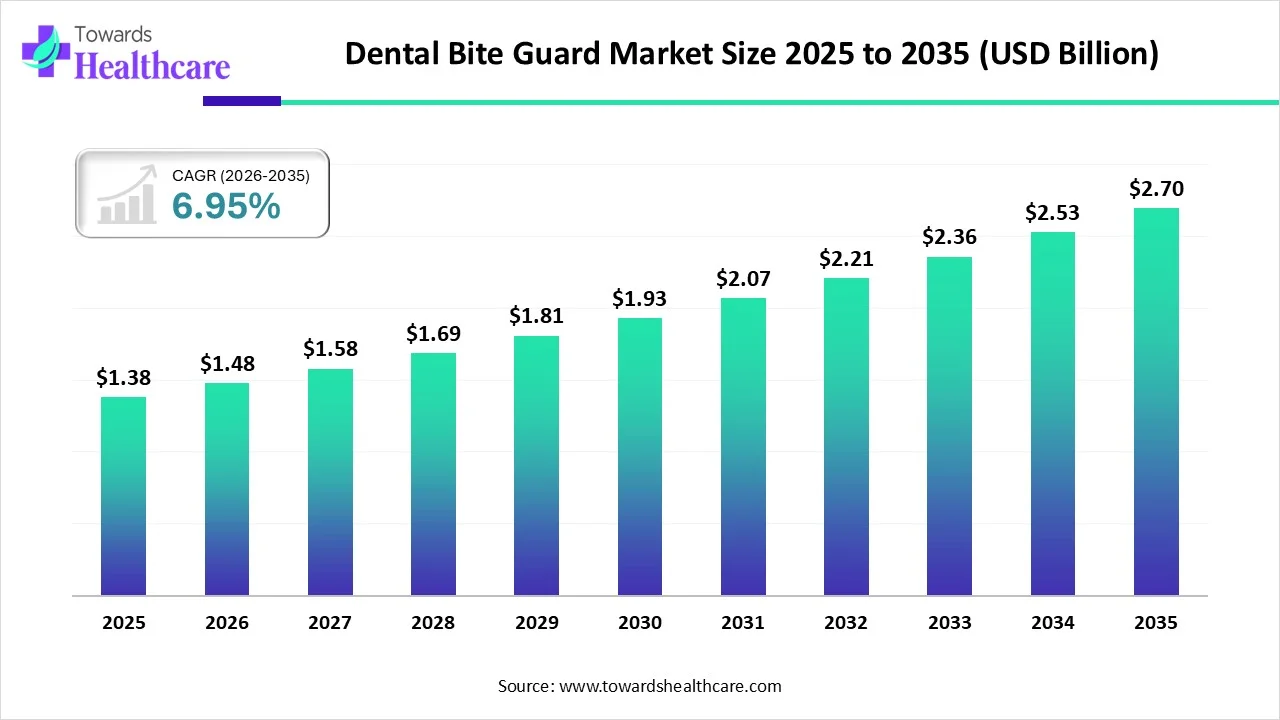

Dental Bite Guard Market to Reach USD 2.70 Billion by 2035, Driven by Rising Dental Issues and Expanding Healthcare Applications

The global dental bite guard market size is valued at USD 1.38 billion in 2025 and is predicted to hit around USD 2.70 billion by 2035, risisng at a 6.95% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Dec. 03, 2025 (GLOBE NEWSWIRE) -- The global dental bite guard market size is calculated at USD 1.48 billion in 2026 and is expected to reach around USD 2.70 billion by 2035, growing at a CAGR of 6.95% for the forecasted period, driven by the growing dental problems and expanding healthcare applications.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6395

Key Takeaways

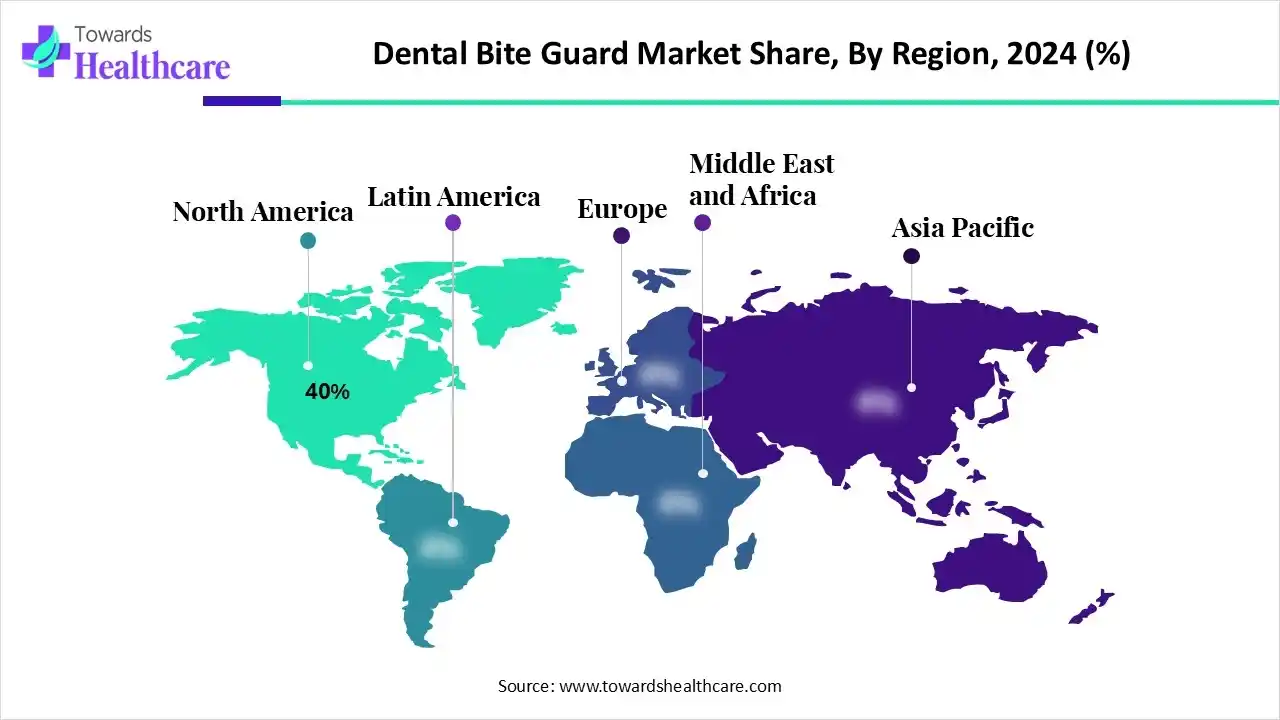

- North America held a major revenue of 40% share of the market in 2024.

- Asia Pacific is expected to witness the fastest growth with a CAGR of 9.0% in the dental bite guard market during the forecast period.

- By product, the custom-fit bite guards segment held a major revenue of approximately 50% share of the market in 2024.

- By product, the boil-and-bite bite guards segment is expected to witness the fastest growth with a CAGR of 8.5% in the market during the forecast period.

- By material, the EVA (ethylene vinyl acetate) segment held a major revenue of 45% share of the market in 2024.

- By material, the polyurethane segment is expected to witness the fastest growth with a CAGR of 8.5% in the market during the forecast period.

- By end user, the clinics & dental practices segment held a major revenue of 50% share of the market in 2024.

- By end user, the sports users segment is expected to witness the fastest growth with a CAGR of 8.5% in the market during the forecast period.

- By application, the bruxism management segment held a major revenue of 55% share of the market in 2024.

- By application, the sports protection segment is expected to witness the fastest growth with a CAGR of 8.5% in the market during the forecast period.

- By distribution channel type, the dental clinics & hospitals segment held a major revenue of 50% share of the market in 2024.

- By distribution channel type, the online retail segment is expected to witness the fastest growth with a CAGR of 9.0% in the market during the forecast period.

What are the Dental Bite Guards?

The dental bite guard market is driven by increasing oral health awareness and bruxism incidences. The dental bite guards refer to the protective devices used to prevent the teeth damage caused by clenching, grinding, or trauma. They also help in reducing jaw and temporomandibular joint (TMJ) pain, soft tissue injury, and jaw injuries.

What are the Major Growth Drivers in the Dental Bite Guard Market?

Growing sports participation is the major driver in the market. This increases the risk of dental injuries in contact and high-impact sports, which is increasing the use of dental bite guards. Additionally, rising disposable incomes, OTC products, and TMJ disorder incidences are other market drivers.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Drifts in the Dental Bite Guard Market?

The market has been expanding due to the growing collaborations to launch and enhance the use of dental bite guards.

- In June 2025, a collaboration between Shock Doctor, which is the world’s leading mouthguard innovator, and HITIQ Limited was announced. The 2 years of expertise in designing mouthguards of Shock Doctor will be integrated with the PROTEQT technology of HITIQ Limited in this collaboration.

What is the Significant Challenge in the Dental Bite Guard Market?

Compliance issues act as the major limitation in the market. The dental bite guards are often bulky, which makes them uncomfortable to use, and allergic reactions are observed due to their materials, which limit their use. Moreover, the high cost of custom guards, replacement issues, and competition from OTC products are other market challenges.

Regional Analysis

Why did North America Dominate the Dental Bite Guard Market in 2024?

In 2024, North America captured the biggest revenue share of 40% in the market, due to the presence of a well-developed dental infrastructure. At the same time, the growing oral health awareness and increasing incidence of dental problems are increasing the demand for dental bite guards. Additionally, increasing sports activities is also increasing their use, where the companies are developing new products with the use of advanced technologies, which has contributed to the market growth.

What Made the Asia Pacific Grow Notably in the Dental Bite Guard Market in 2024?

Asia Pacific is expected to host the fastest-growing market with a CAGR of 9.0% during the forecast period, due to growing oral health awareness and expanding dental clinics. The growing interest in high-impact sports is also increasing their use, where the growing bruxism is also increasing their demand. The expanding online platforms are also increasing their accessibility and affordability, which is increasing their adoption rates, promoting market growth.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By product analysis

Why Did the Custom-Fit Bite Guards Segment Dominate in the Dental Bite Guard Market in 2024?

By product, the custom-fit bite guards segment led the market with approximately 50% share in 2024, due to their enhanced comfort and bite protection. They also helped in reducing irritation and tooth wear. This ensured patient compliance, where their durability also increased their acceptance rates.

By product, the boil-and-bite bite guards segment is expected to show the fastest growth rate with a CAGR of 8.5% during the predicted time, due to their affordability. Their enhanced quality and widespread availability are also increasing their use. The growing bruxism awareness is also increasing its demand.

By material analysis

What Made EVA (Ethylene Vinyl Acetate) the Dominant Segment in the Dental Bite Guard Market in 2024?

By material, the EVA (ethylene vinyl acetate) segment held the largest share of 45% in the market in 2024, driven by its comfort and flexibility. Their shock absorption property increases their use in sports activities. The easy fabrication enhanced their production as well as adoption rates.

By material, the polyurethane segment is expected to show the highest growth with a CAGR of 8.5% during the predicted time, due to its enhanced durability. They also offer elasticity, which enhances their comfort. Therefore, the companies are utilizing them to formulate products with improved performance and flexibility.

By end-user analysis

How the Clinics & Dental Practices Segment Dominated the Dental Bite Guard Market in 2024?

By end user, the clinics & dental practices segment led the market with 50% share in 2024, due to the growing incidence of bruxism and sleep apnea. They also provided customized dental bite guards. Moreover, their improved product quality also increased their use and enhanced patient outcomes.

By end user, the sports users segment is expected to show the fastest growth rate with a CAGR of 8.5% during the predicted time, due to growing sports activities. This is increasing the demand for dental bite guards to prevent dental injuries. Therefore, the companies are developing more comfortable, shock-absorbing, and improved quality bite guards.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By application analysis

What Made Bruxism Management the Dominant Segment in the Dental Bite Guard Market in 2024?

By application, the bruxism management segment dominated the market with a 55% share in 2024, due to growth in the bruxism incidences. This increased the use of dental bite guards to prevent enamel wear, sensitivity, or fractures. Moreover, as a chronic condition, the use of bite guards where increased.

By application, the sports protection segment is expected to show the highest growth with a CAGR of 8.5% during the upcoming years, due to growth in youth sports and their participation. Additionally, the increasing awareness about dental injuries is also increasing their demand.

By distribution channel analysis

Which Distribution Channel Type Segment Held the Dominating Share of the Dental Bite Guard Market in 2024?

By distribution channel, the dental clinics & hospitals segment held the dominating share of 50% share in the market in 2024, due to growing dental problems. They also provided better quality, customized and dental bite guards. Moreover, their treatment plans and reimbursement policies also attracted the patients.

By distribution channel, the online retail segment is expected to show the fastest growth rate with a CAGR of 9.0% during the upcoming years, as it offers a wide range of products. Moreover, the product reviews and discounts are also increasing their use, where their home deliveries are also increasing patient convenience.

Browse More Insights of Towards Healthcare:

The global dental turbine market was valued at USD 249.04 million in 2024 and is projected to reach approximately USD 1,228.14 million by 2034, growing at a CAGR of 17.3%.

The global dentures market was valued at USD 2.31 billion in 2024 and is projected to reach USD 4.42 billion by 2034, growing at a CAGR of 6.7%.

The interdental brush market reached USD 267.57 million in 2024 and is expected to climb to USD 541.3 million by 2034, growing at a 7.3% CAGR.

The global pet oral care products market was valued at USD 3.2 billion in 2024 and is expected to reach USD 5.57 billion by 2034, growing at a 5.7% CAGR.

The subperiosteal dental implants market was valued at USD 571.2 million in 2024 and is projected to reach USD 1,082.33 million by 2034, growing at a CAGR of 6.6%.

The global tooth regeneration market was valued at USD 4.32 billion in 2024 and is projected to reach USD 7.52 billion by 2034, growing at a CAGR of 5.7%.

The global dental engine market was valued at USD 13.92 billion in 2024 and is expected to reach nearly USD 29.78 billion by 2034, growing at a CAGR of 7.9%.

The global dental sealants market was valued at USD 1.14 billion in 2024 and is projected to reach nearly USD 2.48 billion by 2034, expanding at an 8.10% CAGR.

The interdental cleaning products market was valued at USD 1.26 billion in 2024 and is projected to reach USD 2.34 billion by 2034, growing at a 6.40% CAGR.

The Japan intraoral cameras market was valued at USD 108.82 million in 2024 and is forecast to reach USD 366.14 million by 2034, expanding at a 12.9% CAGR.

Recent Developments in the Dental Bite Guard Market

- In November 2025, two cutting-edge technologies, CEREC same-day crown fabrication and T-Scan digital bite analysis, were launched by Fort Bend Dental to provide accurate, comfortable, and fast dental treatments.

- In April 2025, Spark BiteSync, Spark Retainers, and Ormco EtchFree Bonding were the 3 new technologies launched to preserve enamel health and deliver integrated treatment options by Ormco.

Which are the Top Companies in the Dental Bite Guard Market?

- DenMat Holdings

- Pro Teeth Guard

- Dentsply Sirona

- Ultradent Products

- Panthera Dental

- 3M Company

- Great Lakes Dental Technologies

- Keystone Industries

- Henry Schein

- Planmeca

- Smile Brilliant

- Oral Health Group

- Dental Innovations

Dental Bite Guard Market Value Chain Analysis

R&D

To develop smart guards with sensors to monitor and collect data on conditions like bruxism and develop more durable, precise, and comfortable devices with the use of advanced manufacturing, such as 3D printing, is the focus for the R&D of dental bite guards.

Key Players: Dentsply Sirona, Glidewell Laboratories, 3M Health Care, Colgate-Palmolive, GSK.

Formulation and Final Dosage Preparation

The formulation and final dosage preparation of dental bite guards focuses on the fabrication or molding of non-medical biocompatible materials to fit a patient's mouth.

Key Players: Dentsply Sirona, Glidewell Laboratories, 3M Health Care, Colgate-Palmolive, Procter & Gamble, Akervall Technologies Inc.

Packaging and Serialization

The packaging and serialization of dental bite guard involve the protection of the devices, with clear labeling and instructions for their proper use and unique device identification for their traceability.

Key Players: Dentsply Sirona, Glidewell Laboratories, 3M Health Care, Colgate-Palmolive, Procter & Gamble.

Patient Support and Services

Proper fitting of dental bite guards by dental professionals, follow-up care to ensure proper function and address any issues, as well as instructions for cleaning and storage of the guards, are included in the patient support and services of dental bite guards.

Key Players: Dentsply Sirona, Glidewell Laboratories, 3M Health Care, Colgate-Palmolive, Procter & Gamble, Akervall Technologies Inc.

Company Landscape

ShockDoctor

Company Overview

A leading global brand specializing in sports mouthguards and protective gear for athletes.

Corporate Information

- Headquarters: Fountain Valley, California, USA. | Founded: 1993. | Ownership: Private, under United Sports Brands.

History & Background

Founded in 1993, the brand expanded from basic mouthguards into protective sports apparel and accessories. In 2015, the merger of ShockDoctor and McDavid formed United Sports Brands.

Key Milestones/Timeline

- 2015: Formation of United Sports Brands via merger of ShockDoctor and McDavid.

- 2025: Introduced a full packaging redesign, eliminating plastic clamshells and moving to fully recyclable cardboard packaging in the UK/Europe.

Business Overview

Focuses on athlete protection gear: mouthguards, braces, apparel, and related accessories. Sales via direct-to-consumer, retail, and team/league channels.

Geographic Presence

Active globally; packaging redesign referenced UK/Europe markets.

Key Offerings

Mouthguards (boil-and-bite, custom), braces, performance apparel. Packaging redesign included a tiered product ladder “Good/Better/Best”.

Distribution channel strategy

Omni-channel: e-commerce (direct), retail partners (sports/athletic stores), team/league programs (youth and pro). The packaging initiative stressed retail shelf optimization.

Competitive Positioning

Strong brand recognition in sports protection; emphasis on retail-ready packaging and athlete/ambassador programs.

SWOT Analysis

- Strengths: Global brand, innovation, athlete partnerships.

- Weaknesses: High pricing, dependence on the sports segment.

- Opportunities: Eco-friendly packaging, D2C expansion, and emerging markets.

- Threats: Cheaper rivals, market saturation, counterfeit risks, shifting consumer preferences.

Recent News & Updates/Industry Recognitions/Awards

- July 2025: Launched sustainable packaging initiative in the UK/Europe, eliminating plastic clam shells and shifting to recyclable materials.

- Ambassador Program launch/expansion (2025), engaging athletes and social influencers.

OPRO Mouthguards

Company Overview

UK-based specialist manufacturer of technically advanced mouthguards for sports and dental protection.

Corporate Information

Headquarters: Hemel Hempstead, Hertfordshire | United Kingdom. Founded: 1997 | Ownership: Private / family-owned.

History & Background

Founded by a dentist (Dr. Anthony Lovat) to develop higher-performance mouthguards. Grew into a global supplier and official partner for major sports bodies.

Key Milestones/Timeline

- 2023: Partnership announced with Prevent Biometrics to integrate head-impact monitoring sensors into mouthguards.

- 2024 November: Partnership with Crostyx launched for Instant Custom-Fit home mould product.

- 2024 June: Became an Official Supporter of the Rugby Players Association (RPA) in the UK, providing educational resources and custom guards.

Business Overview

Manufactures custom and boil-and-bite mouthguards, including sensor-enabled smart models; serves sports teams, dental professionals, and retail consumers.

Geographic Presence

Global distribution; manufacturing in the UK; partnerships with international sporting bodies and clubs (e.g., Harlequins, RPA).

Key Offerings

Custom-fit mouthguards, Instant Custom-Fit home impression units, sensor-embedded smart mouthguards (with head-impact monitoring).

Business Segments/Divisions

Sports performance mouthguards, dental/therapeutic mouthguards, smart instrumented products, licensed sports partner portfolios (e.g., UFC).

End-Use Industries Served

Contact sports (rugby, MMA, football, etc.), dental clinics (bruxism, night guards), youth clubs, and professional teams.

Key Developments and Strategic Initiatives

- 2023 partnership with Prevent Biometrics for head-impact sensor integration.

- 2024 partnerships and licensing deals: Crostyx (home custom-fit product) and RPA (player welfare) in the UK.

- Multi-year extension of global licensing partnership with Ultimate Fighting Championship (UFC) to produce UFC-branded mouthguards.

Competitive Positioning

Market leader in high-performance/custom mouthguards with sensor technology, strong sports licensing, and clinical credibility.

SWOT Analysis

- Strengths & Differentiators: Clinical and technical innovation (e.g., smart mouthguards), sports-licensing partnerships, and manufacturing expertise in the UK.

- Weaknesses: likely premium pricing vs low-cost alternatives.

- Opportunities: growth in sensor-embedded protective gear, expansion in emerging markets.

- Threats: commoditization of mouthguards, price competition, and alternative technologies.

Recent News & Updates / Industry Recognitions/Awards

- 2024: Renewed partnership with iconic rugby club Harlequins, with new generation smart mouthguards (OPRO+ with PROTECHT sensors).

- 2024 November: Crostyx partnership for Instant Custom-Fit in-home product launch.

- 2023: Partnership with Prevent Biometrics to scale instrumented mouthguards.

Top Vendors and Their Offerings

- Akervall Technologies Inc.: SISU Mouthguards and SOVA Night Guard are the products offered by the company.

- Shock Doctor: The company is providing the Gel Max Mouthguard.

- Oral-B (Procter & Gamble): Oral-B Nighttime Dental Guard is the product provided by the company.

- Glidewell Laboratories: The company provides products such as Comfort H/STM Bite Splint, Comfort3DTM Bite Splint, and CLEARsplit.

Segments Covered in The Report

By Product

- Custom-Fit Bite Guards

- Dentist-Made Bite Guards

- Lab-Fabricated Bite Guards

- Stock Bite Guards

- One-Size-Fits-All

- Pre-Formed Guards

- Boil-and-Bite Bite Guards

- Thermoplastic Guards

- Moldable Guards

By Material

- EVA (Ethylene Vinyl Acetate)

- Polyurethane

- Silicone

By End User

- Clinics & Dental Practices

- Hospitals

- Home Users

- Sports Users

By Application

- Bruxism Management

- Sleep Apnea Management

- Sports Protection

By Distribution Channel

- Dental Clinics & Hospitals

- Online Retail

- Pharmacies & Specialty Stores

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

South America

- Brazil

- Argentina

- Rest of South America

Europe

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6395

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.